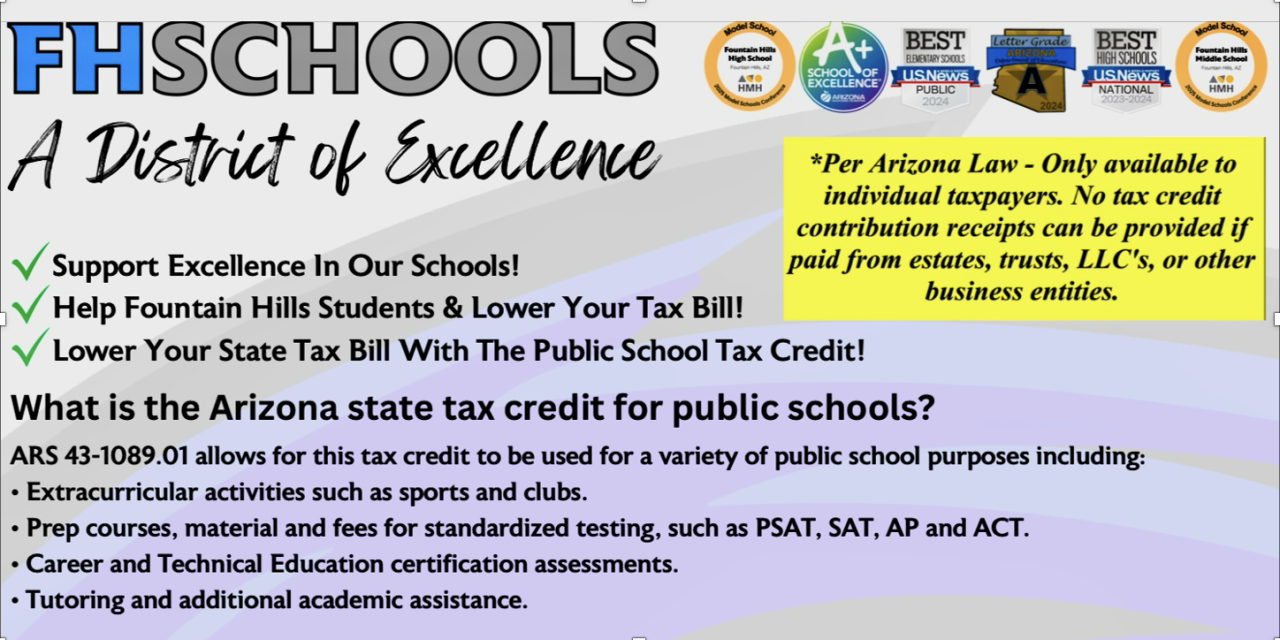

Many of us recently received this mailer from the Fountain Hills School District, urging us to support excellence in our schools by taking advantage of the Arizona state tax credit for public schools.

Almost two decades have passed since the state legislature enacted a statute – A.R.S. §43-1099 – intended to encourage private donations to public schools by giving taxpayers a dollar-for-dollar credit for amounts owed as state income tax for contributions made to public schools. The amount of the credit that can be claimed is subject to a cap, which is currently $200 for those filing an individual return and $400 for those filing joint returns.

Sadly, for our underfunded school district, residents of Fountain Hills have not taken full advantage of this opportunity to redirect their tax dollars to two of our town’s most valuable assets: our schools and our children. If the 2,980 voters who supported the general obligation school bond in 2023 took advantage of the tax credit, we could add up to $1 million dollars to the FHUSD’s budget for extracurricular activities. This figure could easily double if all residents who value our public schools participated in the tax credit program.

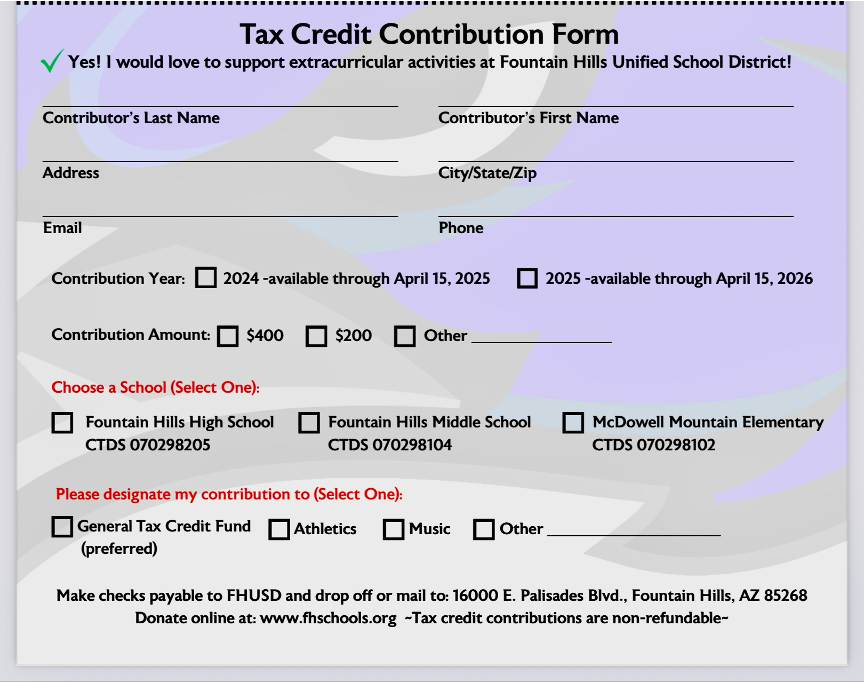

The donations cannot be used to fund capital improvement projects, but provide direct benefit to our students by funding: enrichment activities like field trips, music, and clubs; school sports; prep courses, materials, and fees for standardized tests; career and technical education certifications; and tutoring. Devoting more funds to these extracurricular activities will further enhance the reputation of our schools, diversify and improve the educational experience for our students, and attract new students. The FHUSD has made it easy for residents to participate in this program. You can make your donation online by completing the Tax Credit Contribution Form found on the District’s website: www.fhschools.org.

In the alternative, you can deliver or mail checks payable to FHUSD to the superintendent’s office: 16000 E. Palisades Blvd., Fountain Hills, AZ, 85268.

Getting your tax credit is equally easy to do. When filing your Arizona state income tax return, you only need to:

• Use Arizona Form 322 (Credit for Contributions to Public Schools);

• Enter the amount of your donation (up to the applicable limit); and

• Attach Form 322 to your return.

The clock is running. To qualify for the credit on your 2025 tax return, donations must be made to the FHUSD prior to April 15, 2026.

We can do this Fountain Hills! If we can raise the funds and find volunteers to rebuild a football field, we can raise a million to enhance our children’s education by making a donation and filling out a few forms. Spread the word by sharing this post. We will be reporting on our progress.